Here’s a comprehensive article on cryptocurrency ROI, market makers, and liquidity miners:

“Big Bets: Cryptocurrency Investment Returns, Market Makers, and Liquidity Miners”

In today’s fast-paced digital environment, investing in cryptocurrency is becoming increasingly popular. However, many investors are unsure about the potential ROI. To help them make informed decisions, we’ll look at three key areas that can have a significant impact on cryptocurrency investments: cryptocurrency ROI, market makers, and liquidity miners.

1. Cryptocurrency ROI: The Power of Compound Interest

Cryptocurrency ROI indicates the potential return on cryptocurrency investments over time. This concept is often referred to as compound interest in traditional finance. When you invest in cryptocurrency, it’s not just your initial deposit that grows; also earns interest on its growth.

For example, if you invest $10,000 in Bitcoin at 1% annual interest, you will have earned about $100 in interest after a year. But here’s where the magic happens: Over the next year, Bitcoin could increase in value by 20-50%, generating an additional $2,000-5,000 in return on your investment.

Market Makers: The Unsung Heroes of Cryptocurrency Trading

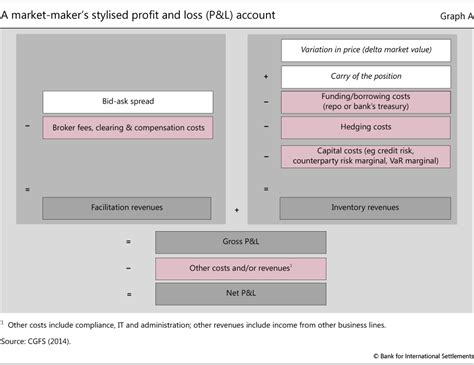

Cryptocurrency market makers (MMs) are individuals or organizations that provide liquidity to the cryptocurrency market. They act as intermediaries between buyers and sellers, allowing them to transact at favorable prices. MMs can help reduce slippage (price volatility) and increase trading volume.

When the price of a cryptocurrency drops, the MM can buy it back from other traders at a lower price and resell it at a higher price, paying the difference. Similarly, when the price increases, the MM can sell it to other traders at a higher price and buy it back to resell at a lower price, making a profit.

2. Liquidity Miners: Those Who Keep Cryptocurrency Markets Running

Liquidity miners are individuals or organizations that participate in cryptocurrency markets by buying and holding large amounts of a particular cryptocurrency. They aim to provide liquidity to the market, ensuring that prices remain stable and trades are executed efficiently.

In exchange for their services, liquidity miners often receive a portion of the transaction fees generated by other traders. This model allows them to profit from market fluctuations while maintaining a steady income stream.

Why Cryptocurrency Investment Returns, Market Makers, and Liquidity Miners Matter

Cryptocurrency investing is becoming increasingly popular, but it’s essential to understand how these three concepts can affect your investment performance. Here are a few reasons why:

- Cryptocurrency Investment Returns: Compound interest can increase your returns over time, making cryptocurrency investments more attractive.

- Market Makers:

MMs help reduce slippage and increase trading volume, making the market more efficient for investors.

- Liquidity Miners: They provide liquidity to the market, ensuring that prices remain stable and trades can be executed efficiently.

By incorporating these three concepts into your investment strategy, you’ll be better prepared to navigate the complex world of cryptocurrency investing. Remember to always do your research, set clear goals and consult a financial advisor before making any investment decisions.