Here is a comprehensive article on “Crypto, Cross Chain, ETFs, and Risk Management”:

“Navigating the Wild West of Finance: Understanding Crypto, Cross Chains, ETFs, and Risk Management”

The financial world has seen rapid innovation in recent years, with several new technologies emerging that are changing the way we invest and manage our assets. At the forefront of this revolution is cryptocurrency, which has gained immense popularity as a digital asset that can be bought, sold, and traded like traditional currencies. However, crypto investing comes with its own risks, and it is essential to understand how to manage these risks through cross-chain solutions, Exchange-Traded Funds (ETFs), and effective risk management strategies.

What is Cross Chain?

Cross chain refers to the process of transferring assets or funds between different blockchain networks. This allows users to move their crypto assets across platforms, such as Ethereum (ETH) on the Ethereum blockchain and Bitcoin (BTC) on the Bitcoin blockchain. Cross-chain solutions allow for faster and cheaper trading, reducing the costs associated with traditional exchanges.

What is an ETF?

An exchange-traded fund (ETF) is a type of investment fund that trades on major exchanges like the NYSE or NASDAQ, just like individual stocks. ETFs hold a basket of assets, such as bonds, stocks, or commodities, and provide investors with instant liquidity. They offer flexibility in terms of diversification and can be traded throughout the day.

Cross Chain Crypto ETFs

A number of cross-chain crypto ETFs have been launched in recent years, allowing investors to gain exposure to multiple cryptocurrencies across different blockchain networks. These ETFs typically track the performance of a basket of assets, such as Bitcoin (BTC), Ethereum (ETH), and others, across different blockchains. Some popular cross-chain crypto ETFs include:

- Kraken Crypto Exchange-Traded Fund (KRX)

- Bitwise Crypto Exchange-Traded Fund (BITW)

- CoinShares Cross Chain Ethereum Trust (CSKT)

Risk Management in the Cryptocurrency Market

While investing in cryptocurrency can be lucrative, it’s important to understand that the market is inherently volatile and subject to various risks. Here are some key risk management strategies:

- Diversification

: By diversifying your investments across asset classes, including stocks, bonds, and commodities, you minimize exposure to any one asset.

- Stop-Loss Orders: Place a stop-loss order that automatically sells a cryptocurrency at a predetermined price if it falls below the current market price.

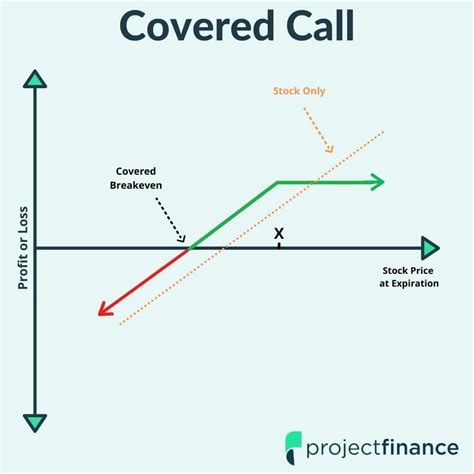

- Hedging: Use derivatives, such as futures or options contracts, to mitigate potential losses if the value of a cryptocurrency declines.

- Risk Reversal: Use risk reversal strategies that involve buying a currency when its price is high and selling it when it is low.

Crypto, Cross Chain, ETFs, and Risk Management: The Bottom Line

Investing in crypto can be a lucrative opportunity, but it requires a deep understanding of the market risks involved. By using cross-chain solutions, ETFs, and effective risk management strategies, investors can navigate these risks and maximize their return on investment. Always remember to do your own research, set clear risk tolerance goals, and consult with financial advisors before making any investment decisions.

As the cryptocurrency market continues to evolve, it is important to stay up to date with the latest developments and trends. This will allow you to make informed investment decisions and minimize potential risks in this rapidly changing environment.