“Crypto, TA, RSI, and Digital Wallet: A Comprehensive Overview”

As the world of cryptocurrency continues to grow and evolve, technical analysis (TA) has become a crucial tool for investors and traders seeking to make informed decisions about these volatile assets. In this article, we will delve into the world of crypto, exploring the essential concepts that have made it so popular among traders.

Technical Analysis

Technical analysis is a method of analyzing price movements in financial markets using charts and graph patterns. It involves identifying trends, patterns, and potential support and resistance levels to make informed trading decisions. In the context of cryptocurrency, technical analysis has proven to be a powerful tool for predicting price movements and identifying potential trading opportunities.

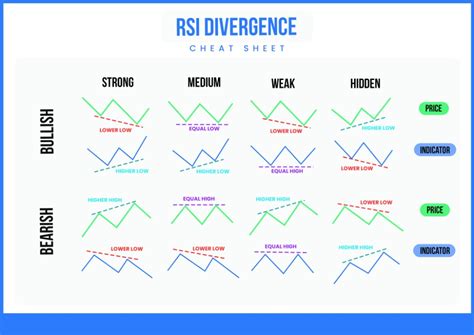

One of the most widely used TA indicators is the Relative Strength Index (RSI). Developed by J. Welles Wilder in 1978, RSI measures the magnitude of recent price changes to determine overbought or oversold conditions. When the RSI falls below 30, it indicates a potential buy signal, while above 70, it suggests a sell signal.

Digital Wallets

As cryptocurrency adoption grows, so does the demand for secure and user-friendly digital wallets. These electronic payment systems allow users to store, send, and receive cryptocurrencies without the need for intermediaries like banks or traditional exchange platforms.

The most popular digital wallet services include Coinbase, Binance, and MetaMask. These wallets provide a range of features, including:

- Security: Secure storage solutions that protect user funds from hacking and theft.

- User Experience: Intuitive interfaces that make it easy to buy, sell, and manage cryptocurrencies.

- Accessibility: Mobile apps and web-based platforms that enable users to access their accounts anywhere.

Cryptocurrency Trends

As the crypto market continues to grow, trends are emerging that can help traders make informed decisions. Some of the most significant trends in cryptocurrency include:

- Goldilocks Zone: The $1,000 price range has emerged as a sweet spot for many investors, providing a balance between safety and potential growth.

- Trend Following: Many traders now use trend following strategies to predict price movements and identify trading opportunities.

- Volatility

: As the crypto market becomes more mature, volatility is increasing, making it essential for traders to adapt their strategies.

Conclusion

In conclusion, technical analysis, RSI, and digital wallets are all essential components of the cryptocurrency ecosystem. By mastering these concepts, traders can make informed decisions about their investments and navigate the ever-changing landscape of the crypto market.

As the world of cryptocurrency continues to evolve, it is likely that these tools will remain at the forefront of trading strategies. Whether you’re a seasoned trader or just starting out, incorporating technical analysis, RSI, and digital wallets into your investment portfolio can help you stay ahead of the curve.

Sources:

- The Financial Times

- Coindesk

- Bloomberg