“Building a Strong Foundation in Crypto with Tokenomics, Supply Chain and Trading Strategies”

The cryptocurrency space is rapidly evolving, and it’s essential for new investors to understand the fundamental building blocks of this industry. In this article, we’ll delve into three critical aspects: tokenomics, supply chain management, and trading strategies.

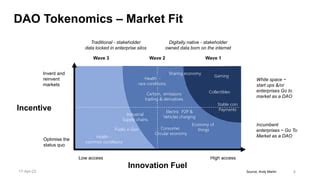

Tokenomics: The Science Behind Crypto Assets

Tokenomics refers to the study of the economics and behavior of cryptocurrency assets. It encompasses various metrics such as supply, demand, price volatility, and market capitalization. Understanding tokenomics is crucial for investors, developers, and market participants to make informed decisions about their investments in cryptocurrencies.

Some key concepts in tokenomics include:

- Supply: The total number of tokens that will be created through a particular event or process.

- Token distribution: The method by which tokens are distributed among different stakeholders, such as founders, investors, and users.

- Price drivers: Factors that affect the price of cryptocurrency assets, including market sentiment, economic indicators, and regulatory news.

Supply Chain Management: Building Trust in Crypto

A well-managed supply chain is essential for building trust within the crypto community. This involves maintaining transparency and accountability throughout the entire process. Some key aspects of supply chain management include:

- Decentralized governance: Creating a decentralized network of decision-makers that can make choices without relying on external entities.

- Smart contract security: Developing and implementing secure smart contracts to ensure the integrity of transactions.

- Audit trails:

Maintaining detailed records of all activities within the supply chain to prevent tampering or manipulation.

Trading Strategies: A Balanced Approach

Trading in cryptocurrency requires a deep understanding of market dynamics, technical analysis, and risk management. A balanced trading strategy should include:

- Risk management: Set clear stop-loss levels and position sizing to minimize potential losses.

- Market analysis: Continuously monitor market trends and adjust positions accordingly.

- Diversification: Spread investments across multiple assets and markets to mitigate risks.

Examples of Successful Trading Strategies

Several traders have successfully employed trading strategies in the crypto space, including:

- Range-bound trading: Buying and selling within a narrow price range to profit from fluctuations in prices.

- Trend following: Identifying and following established market trends to take advantage of strong buying or selling opportunities.

- Momentum trading: Investing in assets with positive momentum, such as those showing significant gains over a short period.

Conclusion

Building a strong foundation in crypto requires a deep understanding of tokenomics, supply chain management, and trading strategies. By mastering these concepts, investors can make informed decisions about their investments and navigate the complex landscape of cryptocurrencies. Remember to always stay vigilant and adapt your strategies as market conditions change.