“Private Keys and Fees: Understanding the Intricacies of Cryptocurrency Trading”

In the world of cryptocurrency trading, security and profitability are paramount. When it comes to buying, selling, or exchanging cryptocurrencies like Bitcoin, Ethereum, or Litecoin, understanding the intricacies of private keys and transaction fees is crucial to making informed decisions.

What is a private key?

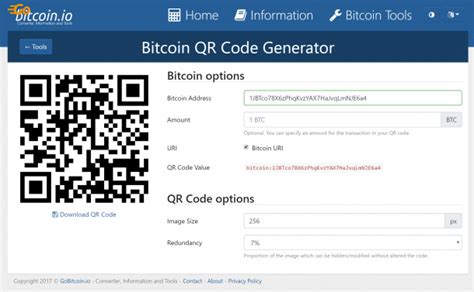

A private key, also known as a passphrase or wallet address, is a unique code used to access and manage cryptocurrency assets. It is essentially the “password” that unlocks the digital wallet that contains your cryptocurrency holdings. Private keys are generated using cryptographic algorithms, making them virtually unbreakable.

Understanding Transaction Fees

Transaction fees, on the other hand, are the costs associated with sending or receiving cryptocurrency transactions. These are usually expressed as a small percentage of the transaction value and can be borne by various parties involved in the transaction process. Transaction fees help cover the operational costs of maintaining the blockchain network, ensuring its integrity, and supporting decentralized applications.

The Role of Private Keys in Transaction Fees

Private keys play a critical role in determining transaction fees. The more private keys associated with a person or entity, the higher their transaction fees will be. This is because transactions involving multiple wallets require additional computing power to validate and settle transactions. As such, holders of private keys typically face higher fees compared to those with fewer private keys.

The Impact of Fees on Cryptocurrency Trading

Transaction fees represent a significant burden for cryptocurrency traders, especially when it comes to frequent or large-scale transactions. High transaction fees can hurt investors’ profits, making it essential to manage your wallet effectively to minimize losses. In addition, fees can also impact the overall cost structure of trading, influencing market dynamics and affecting the purchasing power of individual investors.

Best practices for managing private keys and transaction fees

To reduce the costs associated with private keys and transaction fees:

- Use hardware wallets: Store your private keys offline in a secure physical wallet to prevent unauthorized access.

- Split large transactions

: Break larger transactions into smaller ones to spread the burden of transaction fees.

- Monitor transaction fees: Track transaction fees and adjust your strategies accordingly.

- Consider using alternative payment methods: Some services offer lower or no transaction fees for certain types of transactions.

Conclusion

Private keys and transaction fees are two essential aspects of cryptocurrency trading that require careful management to ensure efficient operations and minimize costs. By understanding the complexities of private keys and transaction fees, traders can make informed decisions and optimize their strategies to maximize profits while minimizing losses.