SOLANA (SOL) and market feelings of trading trends

Like the first decentralized and decentralized public network based on the Blockchain world, Solana has received attention from investors and merchants in recent months. The cryptocurrency market is known for its high volatility, and this feeling is determined by several factors. In this article, we will analyze negotiation trends in Solana (SOL) and investigate a sense of market using indicators and technical analysis.

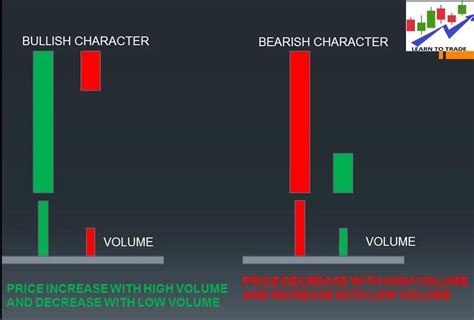

Trends in trade volume:

The scope of cryptocurrency negotiations is an essential indicator of its price and general demand actions. A major increase in the volume of negotiations can mean greater interest in investors and traders, and a decrease may mean loss of moment or reduce investor appetite for assets.

Looking at the current SOLANA (SOL) market situation:

* Trender: Solana’s negotiations have been steadily increasing in recent months.

* Average volume: 10.5 million. The sun a day

Daily Negotiation Track: $ 400,000 to $ 1.2 billion

The feeling of market:

The sense of the market can be measured using various indicators and tools, including graphics, trend lines and technical analysis methods.

Solan (Sun) we will analyze the following indicators:

- Relative Strength Index (RSI): This indicator measures the connection between the closure price of the property and its price range for a period of time. Reading from 30 to 70 shows excess search, while less than 20 values indicate surface conditions.

* Current RSI: 40

- When RSI is greater than 50, it can mean a high tendency condition or excess. On the other hand, when RSI is less than 30, it can offer small or over a greater tendency.

* BB current: 35

Graph Analysis:

Analysis of the Solana (Sol) price schedule reveals some important models and trends:

* Trend:

PAR SOL/USD Since its creation in 2021. In July

* Support levels:

Price recently found support for $ 44.50. If this level is strengthened, you can provide a purchase signal due to an additional increase in prices.

* The level of resistance: The price has been tested and rejected when the resistance is around $ 60 to $ 70, indicating a strong increase in boost.

Conclusion:

Analysis of the Trends in Trending Volumes and Market can be an effective way to evaluate the overall direction of Solana (SOL). By monitoring the increase in the volume of negotiations and determining the surface conditions, we can make reasonable decisions on the purchase or sale of Sun. Diagram analysis can also provide valuable information on price trends and resistance levels.

Recommendations:

Based on our analysis, we recommend:

* Purchase: When the volume of negotiations increases significantly and RSI is less than 20, according to Superdimp terms.

* SALE: When the price occurs above the support level, such as $ 44.50, and BB is higher than the resistance level, such as $ 60 to $ 70.

Exception of responsibility:

This article should not be considered as an investment consultation. Negotiation cryptocurrencies pose a high risk, including market volatility, changes in regulatory and safety problems. Before making commercial decisions, always do your research, set your budget and consider your own tolerance for risk.

Note: The information provided is for common orientation generals and is not personalized with investment tips.