Complex Cryptocurrency Network: Understanding Risks and Dynamics of Market Crypt

The world of cryptocurrencies has seen a meteoric increase in recent years, while prices have risen to dizzying heights and investors demanding a piece of action. Under the surface of this seemingly liquid market, however, lies a complex system of systemic risk, market dynamics and liquidation funds, which may have far -reaching consequences for individuals, institutions and governments.

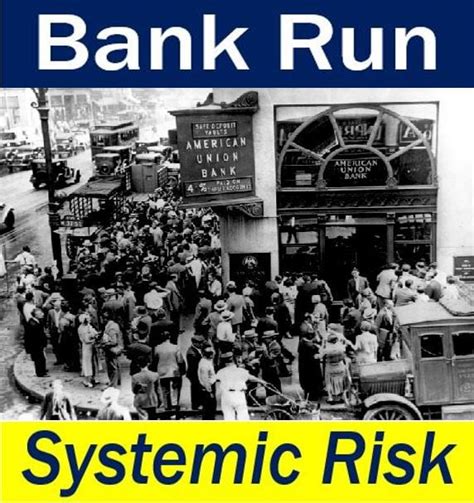

Systemic Risk: Silent Housing

The systemic risk concerns the natural instability of the entire financial system, which can lead to a cascade of failures that have destructive effects on the wider economy. In the context of the crypto market, the systemic risk is particularly acute for the following factors:

1.

- High volatility : cryptocurrencies are known for their extreme prices fluctuations that can lead to rapid capital outflow and market volatility.

- Decentralized nature

: cryptocurrencies work on a decentralized book (blockchain), making it difficult to monitor transactions and identify individuals or subjects involved in illegal activities.

These factors create a systemic risk environment where even minor disturbances can have significant consequences. For example::

- Hacking incident could endanger the safety of the main exchange of cryptocurrency, exposure to users’ funds and lead to a cascading crisis.

- Impact increase in demand for a particular cryptocurrency could increase prices, strain on supply chains and worsening market volatility.

Market dynamics: Factor of unpredictability

Cryptom markets are characterized by their own unpredictability. Prices can fluctuate wildly within minutes, with a small recognizable pattern or logic behind the movements. This unpredictability is caused by a range of factors including:

1.

- Market manipulation : Speculators and merchants can participate in manipulative tactics such as pump and glass schemes to make prices artificially increase.

3.

The result is an environment in which investors leave an effort to understand the rapidly changing market dynamics. For example::

- A sudden increase in demand for a particular cryptocurrency could lead to a rapid increase in prices followed by a sharp correction when investors aware of the risks.

- The spread of misinformation or speculation about cryptocurrency performance can increase prices without any basic logic.

Liquidity area: unsustainable growth

Cryptocurrencies are often characterized by their extremely low liquidity, making it difficult to buy and sell a large number of coins. This lack of liquidity creates an environment that leads to market handling, where speculators can use the leverag effect to intensify their profits while minimizing their losses.

However, the rapid growth of liquidity is unsustainable in the long run. When more people have joined the market cryptomena, demand increases, leading to additional price overvoltages and a reduction in supply. This creates a vicious cycle of speculation and overestimation that can eventually collapse:

- If enough investors starts selling a specific cryptocurrency at high prices, the remaining coins remain highly prone to sharp correction.

- Increased liquidity demand may lead to a reduction in trading volumes that worsen market volatility.