Title: Understanding the Complex World of Cryptocurrency: A Guide to Crypto Instruments, Market Correlation, Future Expiration, and Blockchain Exploration

Introduction

The cryptocurrency market has seen significant growth and volatility in recent years. With the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs), the digital asset landscape is becoming increasingly complex. In this article, we will examine three key topics that are essential to understanding the world of cryptocurrency: crypto market correlation, futures expiration, and blockchain mining instruments.

Crypto Market Correlation

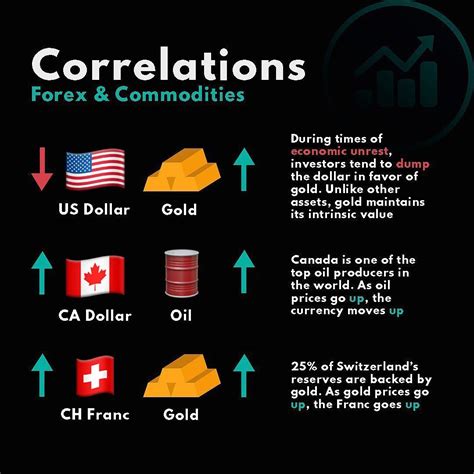

Crypto market correlation refers to the relationship between the prices of different cryptocurrencies and the overall cryptocurrency market. This concept is essential for navigating the ever-changing landscape of digital assets. If the price of one cryptocurrency increases, it can have a ripple effect on other currencies that are highly correlated with it. For example, if Bitcoin (BTC) experiences a significant increase in value, the value of Ethereum (ETH) may also increase.

Understanding crypto market correlation is vital for investors and traders who want to minimize their losses and maximize their profits. By identifying correlations between different cryptocurrencies, you can make more informed investment decisions and avoid costly mistakes.

Fixed Expiration

Futures expiration refers to the time period in which a futures contract expires, marking the end of the trading cycle. In traditional finance, futures contracts have a fixed term, typically ranging from one month to two years. However, in the cryptocurrency market, futures expiration is more complex due to the volatile nature of digital assets.

When the price of a cryptocurrency approaches or exceeds its target value, a futures contract can trigger an expiration event. This event marks the end of the trading cycle and triggers the liquidation of the underlying asset. To avoid missing out on potential profits, investors should be aware of upcoming futures expiration events and adjust their strategies accordingly.

Block Explorer Tools

Block discovery tools are essential for anyone looking to gain insight into the blockchain ecosystem. These tools allow users to query the blockchain for specific information, such as block data, transactions, and addresses. Blockchain explorers like Ethereum’s Chainlink, Polkadot, and Solana provide a wealth of data that can help traders and investors make informed decisions.

Some common use cases for blockchain mining tools include:

- Transaction Tracking: Block explorers allow users to track the progress of transactions on a given blockchain, allowing them to identify potential security threats or opportunities.

- Smart Contract Analysis: By querying smart contracts on blockchains like Ethereum, users can analyze their operation and identify potential vulnerabilities.

- Predictive Analytics: Some blockchain discovery tools use machine learning algorithms to predict market trends and sentiment, helping investors make more informed decisions.

Conclusion

Understanding cryptocurrency market correlation, futures expiration, and blockchain discovery tools is essential for anyone interested in the world of cryptocurrency. By mastering these concepts, you can gain a deeper understanding of the complex landscape of digital assets and make more informed investment decisions.

As the cryptocurrency market continues to evolve, it is essential to stay informed about market trends and technical details that affect your investments. With the right tools at your disposal, you can confidently navigate this fast-paced environment and achieve your financial goals.