Understanding the risk of the bear market: guide to the investment of cryptocurrencies

The cryptocurrency market has experienced significant variations over the years, and prices have often increased and then collapse. Although some investors have previously received considerable profits, the trade in cryptocurrencies during the lowering market can be very risky. In this article, we deepen the risks linked to going to the commercial market and provide valuable information to those who wish to invest in their cryptocurrency.

What is the bear market?

The bear market occurs when the price of an asset, such as currency, share or goods, decreases its historic average. This may be due to the reduction in investor confidence, increased competition from other funds or general economic slowdown. The bear market generally lasts several months in a few years, although it is not uncommon for the market to experience short consolidation periods before continuing the bill.

Risks associated with Karhumarket trade

Cryptocurrency trade during the lowering market presents significant risks for investors. Here are some key concerns:

- Loss of capital

: The bear market can lead to a rapid drop in price, which means that investors who sell at the top of the market can see their defeat strengthened.

- Liquidity losses : When the market decreases considerably, the liquidity of the cryptocurrency can decrease, which makes it difficult and effectively to buy or sell traders quickly and efficiently.

- Volatility of the market : The bear market is characterized by high volatility, which can cause significant price fluctuations and a reduction in trading volumes.

- Marginal hugs Augent : During the bear market, the value of a merchant account can be at risk, which can lead to a margin that can force traders to sell funds at unfavorable prices.

- Court of the Court : Some investors can be subject to debt due to the holding of the encryption currency, which can make it difficult to restore losses during the bear market.

Market conditions for cryptocurrency

There are several market conditions which can affect the level of risk of trading of cryptocurrencies:

- Trendy regulations

: When prices run in the direction and rise, the risk is relatively low.

- Market focused at the moment : high -speed markets are generally more unstable and risky during the bear market.

- Support levels : Traders may need to buy funds at support levels to limit losses, which can increase the risk of reducing these levels.

Risk strategies of the bear market market

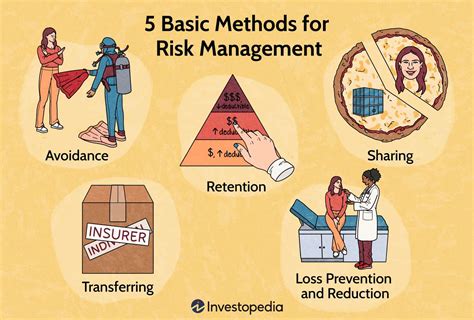

Although there are no empty strategies on the lower market, traders can take several measures to minimize their exposure:

- Diversification : Apply investments in several classes of cryptocurrency or assets to reduce dependence on property.

- Stop the lottery controls : Use the STOP lottery controls for automatic property sale when prices fall below a certain level, which limits the losses.

- Protection strategies : The use of payroll strategies such as institutional options or term contracts to limit losses during the lower market.

- Risk management : Define realistic risk parameters and keep to avoid additional investments.

Invest in cryptocurrencies during the bear market

Although there are significant risks associated with the cryptocurrency trade during the lowering market, some investors can still be able to benefit from the opportunity. Here are some tips:

- Buy Low : Find opportunities to buy funds at depressed prices, especially if you have a long -term perspective.

- Stay up to date : Stay up to date with the development of the market and adjust your strategy accordingly.

- Be patient : Avoid making impulsive decisions only with short -term price changes; Instead, focus on long-term strategies.