**

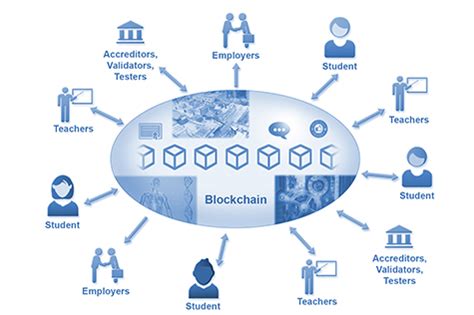

As Limited or non-existent, decentralized finance (defi) has emerged as a promising solution. Defi platforms use blockchain technology and cryptocurrencies to provide fast, cheap, and secure lending, borrowing, and trading services to individuals and businesses alike.

What is Defi?

Defi refers to the broader category of decentralized financial systems that operate on blockchain networks. These platforms are designed to be open-source, transparent, and community-driven, allowing for greater control over transactions and decision-making processes. The Primary Use Case for Defi Are:

- Decentralized Lending

: Platforms like makerdao and compound enable users to lend or borrow cryptocurrencies without the need for intermediaries.

2.

.

EMERGING MARKETS AND THE RISE OF DEFI

In emerging, Countries with vast populations, limited infrastructure, and high transaction costs present a unique opportunity for Blockchain-Based Solutions to transform traditional banking systems.

1.

- India’s Blockchain-Based Lending Platform :

.

Challenges and Opportunities

While defi holds great promise for emerging markets, there are several challenges that need to be addressed:

1.

2.

- Security Risks :

Despite these challenges, emerging markets have the potential to drive growth and adoption for Defi:

- Limited competition :

2.

.

Conclusion

The future of decentralized finance in emerging markets tremendous promise.